Contents

OTC stocks are stocks that do not meet the minimum price or other requirements for being listed on exchanges. A stock market index is a theoretical portfolio of investment holdings that represent a particular segment of the financial market. However, there are approximately 5,000 indexes for the U.S. equity markets alone. Most of the indexes have a very specific focus based on a sector (e.g. biotech, utilities) or investment objective (e.g. fixed income, growth).

The heightened activity in retail trading, especially from Asia Pacific, already has been reflected in the traffic flowing through order management systems . Trading during the main forex market sessions, like the New York and London session, offers the advantage of a reduced spread and increased volatility. You can start with Australia and Tokyo in Asia, then move to Singapore, later trade in London or Frankfurt in Europe and finish on the U.S. markets. Sure, you can do that if you can handle sleeping for three hours or less.

I neither have time to read all that, nor will I accept suspicious data collection just to show a clock. New one looks very cool but needs more work to solve the bugs .. I am still using the previous version as its better , I like to see this app more pro in terms of technical issues. Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. The developer provided this information and may update it over time.

In addition, there is no quote protection under Regulation NMS during those sessions, requiring brokers to get the best available price in the market. He also cites wide spreads and risks from corporate actions, including ex-dividends, reorgs, and stocks splits, which can cause dislocations in price. While focused on the overnight period when U.S. exchanges are closed, Hyndman believes there is demand for 24-hour trading in U.S. equities. “We really see US equities going 24 hours a day five days a week,” he said, noting that the futures exchanges already trade 23 hours a day and the crypto market trades 24-hours a day. Trade in the stock market can only be undertaken during a specific time interval in India. Retail customers have to perform such transactions through a brokerage agency between 9.15 a.m.

But it really gives any investor the ability to manage their risk 24 hours a day,” said Brian Hyndman, President and Chief Operating Officer of Blue Ocean Technologies, in an interview. On Oct. 5, Blue Ocean ATS launched the first regulated dark pool advantages of amazon business account for overnight trading in response to the demand for U.S. stocks from retail investors in Asia-Pacific. The startup ATS has partnered with leading broker-dealers that serve institutions and cater to retail investors, according to the company.

Crypto Assets Expand your knowledge about investment opportunities in crypto assets on our spotlight page. Investors will own company shares in the expectation that share value will rise or that they will receive dividend payments or both. When running it the first time, it insists that we sign a many pages long contract about them collecting data and what not.

McDonald’s is an example of a multinational corporation offering access to dozens of markets. There are many ways to take advantage of investment opportunities across the globe. While the New York Stock Exchange and the Nasdaq are two of the most well-known stock exchanges, there are others for investors to consider in Canada and Mexico. These areas have higher real estate prices, making stores there more valuable. MarketBeat does not provide personalized financial advice and does not issue recommendations or offers to buy stock or sell any security.

hour stock trading never took off; here’s why

When one region’s business hours end, another opens which allows forex to trade continuously until the weekend. Although the forex market is open 24 hours a day five days a week, it is not always liquid. There are specific times during the day when the volume traded on the forex market is high.

“The difference between stocks and commodities is that there are people all over the world wanting to buy wheat. Not everyone around the world wants to buy Chuck E. Cheese stock. At some level, it’s that simple,” said Ian Domowitz, managing director at Investment Technology Group, an independent agency research broker.

Market 24h Clock 1.0

Euronext is based in Amsterdam but has offices throughout Europe. It has roots back to the early 1600s and is considered the oldest modern securities market in the world. South American countries like Brazil and Argentina boast some sizable emerging economies and potentially solid investment opportunities. But now, amid the coronavirus pandemic, this trade has reversed. The most common types of weighting are market-cap weighting, revenue-weighting, float-weighting, and fundamental weighting.

But even if policy makers addressed those technicalities, he added, investors might still want to trade stocks in the most liquid market during their day — most likely their home market. Direct Edge’s Harkins also said a greater presence of market makers could improve trading volumes during extended hours. “Ultimately, exchanges are typically doing what brokers want … There is just not enough liquidity in the middle of the night and investors are not really demanding that. One way to look at it is, ‘Convenience is great, but I’d rather have a better price,’” he said. Few dispute the advantages of continuous trading, like the ability to act immediately on news — such as Microsoft Corp.’s MSFT, -0.49%earnings, or China’s inflation data. For non-professional investors, the convenience of selling stock at 11 p.m., after finishing daily chores or putting the kids to bed, could be useful.

- But even if policy makers addressed those technicalities, he added, investors might still want to trade stocks in the most liquid market during their day — most likely their home market.

- With some of the most populous countries in the world located in the Eastern Hemisphere, there are huge trading opportunities to be found on the exchanges in India, South Korea, Japan, and China.

- This time acts as a transition period between preopening and normalIndian share market timing.No additional orders for transactions can be placed during this time.

- The required physical infrastructure is also in place, thanks to the ability of electronic networks to connect buyers with sellers.

The required physical infrastructure is also in place, thanks to the ability of electronic networks to connect buyers with sellers. The term dotbig website refers to several exchanges in which shares of publicly held companies are bought and sold. Such financial activities are conducted through formal exchanges and via over-the-counter marketplaces that operate under a defined set of regulations. In addition https://1investing.in/ to the rise of the NASDAQ, the NYSE faced increasing competition from stock exchanges in Australia and Hong Kong, the financial center of Asia. Stock market investments can only be undertaken through brokerage agencies for standard customers. Orders for specific securities can be placed online, and a stockbroker having direct investment access can transact the request with a T+2 settlement buffer period.

Why does the FX market trade 24 hours a day?

“Let’s say on a Sunday night, there is some type of geopolitical event or oil is rising or falling in price. You don’t have to wait until the next morning,” said Hyndman. Right now, investors need to put in a limit order and hope it gets executed overnight in their time zone or go buy mutual funds, he said. “It’s designed to give Asian investors the ability to trade U.S. stocks during their day-time hours.

When you need to know what time it is on any particular market and what is its status, this app page is for you. Though U.S. brokers were not ready a couple of years ago, a global 24-hour trading mindset is evolving said Hyndman. “We are giving access to Asian investors who are reaching out to their U.S. brokers and asking how to get connected. “Ultimately the stock market is going to compete with the crypto market,” said InvestorsHub.com’s Clem Chambers.

Any requests placed during this time can be changed or cancelled according to need, which is beneficial to investors, and no orders can be placed after this period of 8 minutes during the pre-opening session. Tap on any market to see its current status, local time and trading hours both local and in your time zone. Galinov maintains that volatility will attract market makers and other participants to 24-hour trading, and over time, price swings will stabilize. “That’s why bitcoin and all those other cryptocurrencies are popular,” he said.

Following an IPO, the stock exchange serves as a trading platform for buying and selling the outstanding shares. The stock exchange earns a fee for every trade that occurs on its platform during secondary market activity. Both “stock market” and “stock exchange” are often used interchangeably. Traders in the dotbig forex buy or sell shares on one or more of the stock exchanges that are part of the overall stock market.

World Markets »

Traders on the TD Ameritrade platform are now able to buy and sell shares of ETFs like the SPDR S&P 500 at any time of day. Such a move could lead to massive job creation on Wall Street in operations for equities, an area that has been heavily cut by Wall Street, he said. Jobs will be created to service the customer 24/7, just as banks hired for their FX businesses. “If the platform is a single system, it’s going to create more jobs, because the system will operate longer in multiple asset classes,” he said. Instead of having 1400 hours a year to generate revenue, Wall Street will have 8600 hours a year to make money, he said.

We also have in-depth research on the number one biggest mistake traders make, which offers useful tips for executing successful trades. So I think that there is always some stock exchange opened and it is possible to do 24 hour stock trading. Liquidity during off-hours could improve, at least in theory, if investors outside the U.S. were able to trade stocks here during their day. It’s not just the lack of demand that makes after-hours trading thin. The supply is also affected as several market-makers — firms that buy and sell stock for their own account or on behalf of clients — aren’t active during the extended hours.

“An unaccountable number of exchanges are run out of people’s bedrooms,” he said. “If they can provide 365 hours-a day-service, why can’t the NYSE or Nasdaq do it,” he exclaimed. Pointing to the fact that crypto venues offer 24-hour trading, some industry sources insist this is inevitable for U.S. stocks traded on exchanges and other venues. When news breaks overnight or on the weekend, this gives investors the ability to enter a position or exit a position to adjust their risk.

How many stock markets are there around the world?

Bilateral order matching system is volatile, thereby inducing several market fluctuations which are ultimately reflected in security prices. To control this volatility, the multi-order system was formulated for the pre-opening session and was incorporated inIndian stock market timings. The Clock shows the entire trading day – 24 hours so that you could continuously observe and track the Forex market. As the hour hand moves, markets and Market Activity Periods are lighten up.

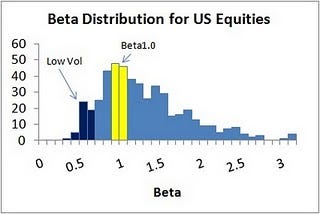

Consol Finvest closes above its 30-Day,50-Day,150-Day,200-Day Moving Average today. Supreme Ind closes above 30-Day,50-Day Moving Average today. The greatest amount of volatility happens during market open overlap. Still, the absence of a large pool of participants posed risks and could make those specialists and broker-dealers less efficient in the markets they were making, he added. Earlier this year, a Nasdaq spokesman told MarketWatch that about 2% of the volume on Nasdaq and NYSE was generated during off-hours.

However, investors in those markets can trade into the midnight hours, should they choose. Trading in foreign exchange and Treasurys takes place 24-hours a day for the most part of a week. Commodity and stock index futures also can be traded virtually around the clock every trading day.